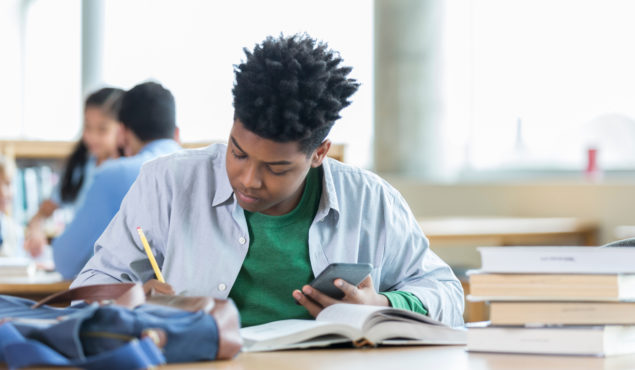

Making the Right Money Moves is a seven-lesson financial skills course taught by school faculty.

The investment in education your credit union needs to yield knowledgeable new members. Credit unions nationwide use Making the Right Money Moves to teach young adults in the classroom basic money management skills, including how to access and manage credit responsibly.

Why do teens need it?

The average high school graduate lacks basic personal financial skills. Many cannot balance a checkbook and most have no insight into the basic principles of earning, spending, or saving.

Making the Right Money Moves helps students learn to manage their first credit experience and establish valuable lifelong financial habits. Rather than stumbling through their financial life by trial and error, teach them in the classroom where mistakes do not cost ‘real’ dollars.

What are the program components?

There are four curriculum components available to each ordering teacher:

- The Student Workbook branded with your credit union’s logo (available in Paper or Digital Format)

- The 40-page Teacher’s Guide

- Our online video, Check It Out!! – checking account convenience, management and the 5 C’s of credit; as well as access to a video on Identity Theft

- An additional online exercise, You’re on Your Own – money management

Teachers request the number of workbooks needed for their classes and a Teacher’s Guide. You receive the fifth component directly: Your Credit Union Guide, which provides ideas and recommendations for maximizing your participation in the program.

What concepts are covered?

- The Credit Union Story

- Budgeting

- Personal Savings

- Basic Investments

- Checking Accounts

- Credit

- Loans

- Loans to Avoid

- Electronic Banking

- Deposit Image Technology

- Online Banking

- Online Bill Paying

- Mobile Banking

- Mobile Text Banking

- Mobile Wallet

- Identity Theft

- Protecting Your Personal Information

And much more…

Here is what teachers say about the program

“Thank you for providing this wonderful resource. So many students have never been taught money management. I incorporated the checking account lesson in my accounting class. Many students from prior school years tell me they remember that lesson the most!”

“Information and activities in this workbook are excellent and have provided real life examples for students’ financial planning skills. The activities have facilitated learning about the necessity of planning and making wise decisions to achieve financial security. Thanks.”

“Thank you for the AMAZING materials! I teach financial math and the purpose of the class is to teach students to be financially secure. These materials help them understand not only how to do it but why.”

“My classes love doing these real-world assignments. Most of my students are seniors and they are getting ready to make their own banking and financial decisions. This program gives them the opportunity to practice these skills in a safe environment.”

“Thank you for providing these workbooks to my Financial Literacy classes. It is so important for students to understand checking and not just the use of debit cards. Understanding a statement and learning how to reconcile an account has been very valuable to my students!”

“This is a great, real-life program to teach students about managing their finances, balancing a checkbook, and explaining various financial terms. I use it yearly in my classes. Thank you for a wonderful resource!”

Our Guarantee

As your silent partner, we are committed to increasing your stature and presence in the community. All contacts with schools are made in your name; the students’ materials prominently display your logo.

Learn More